Our Experience

Norris Realty Advisors specializes in highly complex and unusual valuation assignments. Below find a summary of significant consulting and appraisal assignments completed over the past 30+ years.

COMMERCIAL REAL ESTATE VALUATIONS

SOLAR TWO

SOLAR TWO

Norris Realty Advisors provided appraisal, analysis, and determination of fair market rent for 6,500 acres (10 square miles) of land for the development of one of the largest proposed solar power plants in the world. Valuation conducted for federal guideline schedule and benchmarking purposes for the US Department of the Interior.

MORTGAGE REFINANCING

MORTGAGE REFINANCING

Provision of consultation and valuation for the Century Plaza Towers and ABC Entertainment Complex in Century City, California. The 2,800,000 square foot office and retail development includes two 43-story office towers, the Schubert Theater, and a retail shopping complex. This assignment included the valuation of a number of other significant buildings in Century City over a period of years.

PORTFOLIO VALUATION

PORTFOLIO VALUATION

The firm is retained annually to appraise varying portfolios of income properties for both estate planning and for IRS valuation benchmarking throughout the Western US. Portfolio size and ownership entity names are held in the strictest confidence, with combined values often well in excess of $100 million.

COMPLEX CASH FLOW ANALYSIS

EL TORO (HERITAGE FIELDS)

EL TORO (HERITAGE FIELDS)

Consulted on the public sale of the former 4,800-acre El Toro Marine Corp Air Station. This assignment included the review of the proposed land use plan and entitlement process, research and subdivision analysis of potential market value for the finished master planned development, and the study of the substantial infrastructure costs of the development.

PROFESSIONAL AND PUBLIC SPORTS VENUE CONSULTING

PROFESSIONAL AND PUBLIC SPORTS VENUE CONSULTING

Norris Realty Advisors provides a variety of consulting services related to proposed transfers of ownership of major public and private sports venues, including professional baseball, soccer, and basketball stadiums. This involves the valuation of underlying land, improvements, and study of long-term complex lease agreements. Property locations are typically not disclosed unless involving a publicly held asset. Valuation and consulting efforts include detailed research of various hypothetical redevelopment efforts, as well as complex discounted development cash flow modeling used to determine various ranges of value.

DENVER – LOWRY AIR FORCE BASE

DENVER – LOWRY AIR FORCE BASE

The firm provided extensive consultation and planning for redevelopment, encompassing the review of “broken” and inefficient developmental models for the reuse of over 800 acres, including residential subdivision, office and retail development, and public parks. The firm has valuation and consulting experience in the redevelopment of over a dozen former US Air Force bases throughout the Western United States and Alaska.

ESTATE & TRUST VALUATIONS

MAJOR INVESTMENT PROPERTIES

MAJOR INVESTMENT PROPERTIES

Norris Realty Advisors has completed a portfolio of major investment properties throughout Southern California consisting of:

• More than 1.5 million square feet of office, light industrial flex uses, Internet and film sound studios. This complex estate valuation was conducted for IRS tax filing purposes consistent with a retrospective date value concurrent with the date of passing of the Principal of the development firm.

• A new coastal waterfront destination restaurant and entertainment project of over 120,000 square feet. This property was partially completed at the point of valuation.

• Multifamily residential land to be entitled with over 750 units of apartment units including low-income housing.

SHOPPING CENTER PORTFOLIOS

SHOPPING CENTER PORTFOLIOS

The firm completed the valuation of 20 separate grocery anchored shopping centers for IRS reporting purposes. The properties were located throughout California and Colorado and were typically from 50,000 to 125,000 square feet in size. All properties were valued using industry standard Argus Enterprise Discounted cash flow software in order to accurately track income and expenses over a 10 year forward time period.

LAND VALUATION

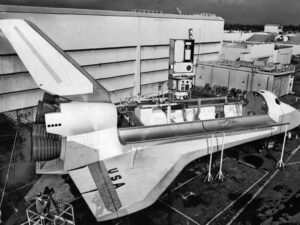

DOWNEY NASA APOLLO FACILITY

DOWNEY NASA APOLLO FACILITY

Completion of valuation for the potential governmental transfer of the 94-acre former home of the West Coast support division for the Apollo and Space Shuttle program. Consultation and valuation provided for site improved with over 1,200,000 square feet of highly specialized assembly, office and research and development space.

SCLA

SCLA

Norris Realty Advisors’ multi-year assignment involved appraisal, consultation, and eminent domain assistance for Southern California Logistics Airport (SCLA), formerly George Air Force Base, as well as a proposed multimodal logistics and freight transportation hub. One of the largest proposed developments in the Inland Empire, this master planned commercial/industrial project contains 2,000 acres of land, which at completion was proposed to consist of a total of 65 million square feet of improvements. Related assignments over the years have included the land valuation assistance for more than 100 separate ownerships for a proposed combination natural gas and solar power generating facility adjacent to SCLA.

EIELSON AIR FORCE BASE

EIELSON AIR FORCE BASE

Norris Realty Advisors conducted a study of demand and supply, as well as current market value of military housing associated with Eielson Air Force Base. The military housing units were constructed on government leased land, and our analysis determined market value for the dissolution of the ground lease agreement with a private developer. The property consisted of 300 apartment units, constructed in 1986 on a site of 57.81 acres.

LITIGATION SUPPORT AND TESTIMONY

“THE MOUNTAIN” – BEVERLY HILLS

“THE MOUNTAIN” – BEVERLY HILLS

Over two years of data collection and report preparation prior to testimony related to an iconic small luxury single family residential subdivision (home sites) near the peak of the Santa Monica Mountains above Beverly Hills, California. The litigation was related to property value loss created by former Trustees of the estate controlling the asset for more than 15 years without a single sale of any of the home sites. Testimony for the owners of the Trust with successful outcome for the client.

REAL ESTATE CONSULTING AND APPRAISAL

PORT PROPERTIES

PORT PROPERTIES

Norris Realty Advisors has been retained on numerous occasions for the valuation of highly specialized port properties, including estimation of fair market rent for the largest container terminals on the West Coast. Provided consultation and cash flow analysis of a proposed 75-acre cargo staging facility with a development budget of over $125 million. The determination of rent involves a complex review of a variety of factors relating to container terminal operation, including the minimum annual rent guarantee, wharfage fees, rail services fees, long term studies of land value trends, as well as a survey of required return rates for port-related properties.

Appraisals for Charter & Private Schools and Complex College Campuses and Retreat Centers

Appraisals for Charter & Private Schools and Complex College Campuses and Retreat Centers

For decades we have specialized in valuation and consulting related to educational facilities. This work includes more that 100 charter schools, as well as numerous private schools, and both existing and proposed college campuses and retreat centers.

REAL ESTATE TAX APPEAL

L.A. LIVE | LOS ANGELES, CA

L.A. LIVE | LOS ANGELES, CA

Norris Advisors prepared initial project budgets and long-term discounted cash flows for the retail entertainment portion of L.A. Live, consisting of 490,000 rentable square feet in two main buildings containing retail, restaurant, night club, television production, and office uses. This project is located adjacent to the downtown Los Angeles Crypto.com Arena and Peacock Theater.

Transportation / Infrastructure Right of Way

Los Angeles METRO System

Los Angeles METRO System

The firm has been involved with a wide variety of specialized right-of-way projects for the expansion of the METRO system throughout Los Angeles. These include the Expo Phase 2 to Santa Monica and the Green Line to LAX. The firm has also completed work on properties associated with the Regional Connector in Downtown.